How to Calculate Gross Margin Using Specific Identification

The specific identification costing assumption tracks inventory items individually so that when they are sold the exact cost of the item is used to offset the revenue from the sale. Assume this company sells three products and the resulting calculations were 1875.

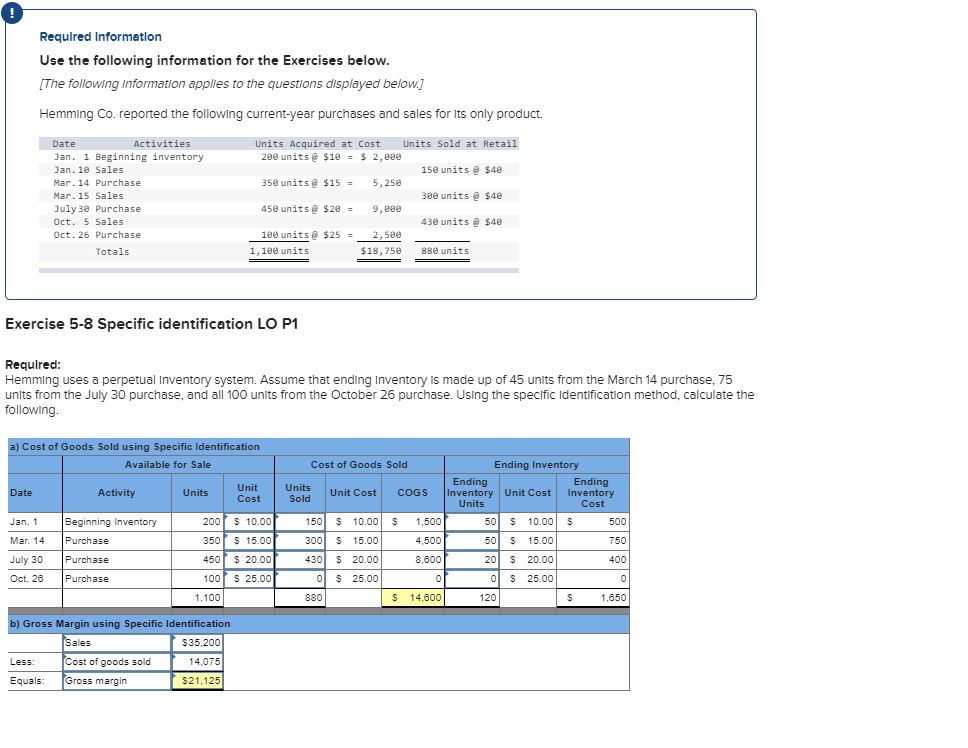

Solved Required Informetlon Use The Following Information Chegg Com

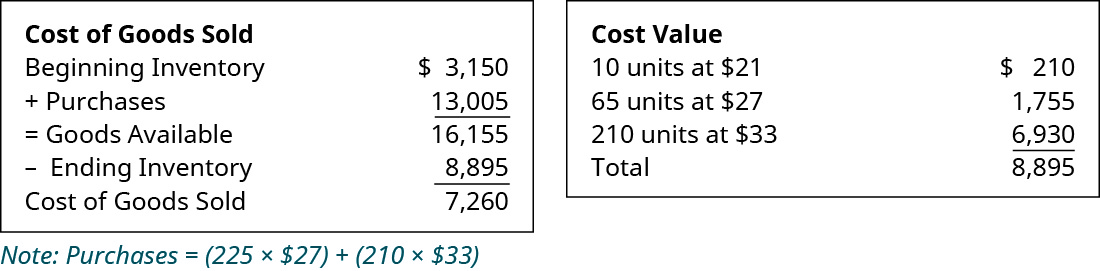

COGS calculation is as follows.

. Subtract the result from 1. It subtracts the cost of sold goods from net sales. Using the formula the gross margin ratio would be calculated as follows.

To arrive at the gross margin percentage we need to divide the gross margin calculated above from the net sales. Divide the cost of the item by the result to find the retail price at the specific profit margin you want. Calculations of Costs of Goods Sold Ending Inventory and Gross Margin Specific Identification.

Margin Formula for a product. A good gross margin in one industry is not necessarily good for another. Answer is not complete.

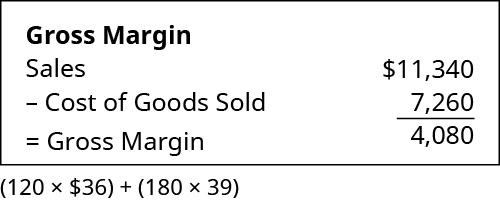

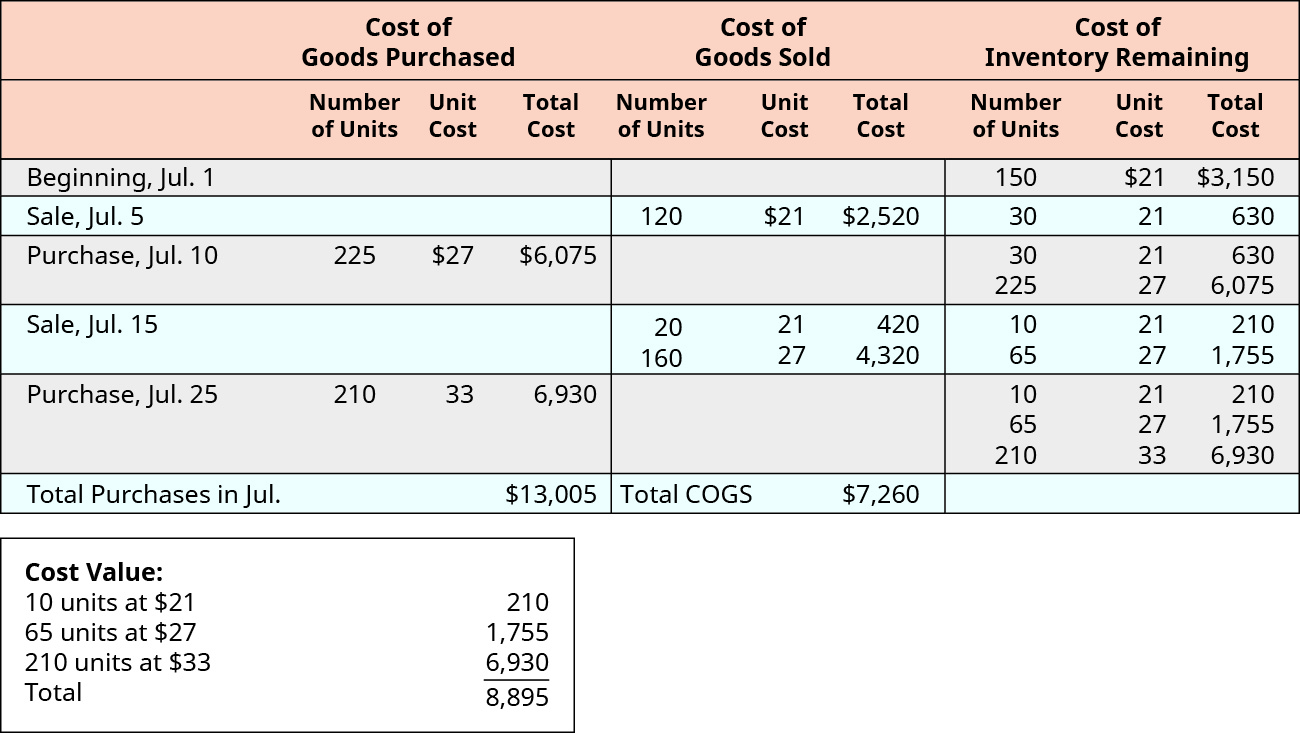

The cost of goods sold inventory and gross margin shown in were determined from the previously-stated. The cost of goods sold inventory and gross margin shown in were determined from the. The specific identification method of cost allocation directly tracks each of the units purchased and costs them out as they are sold.

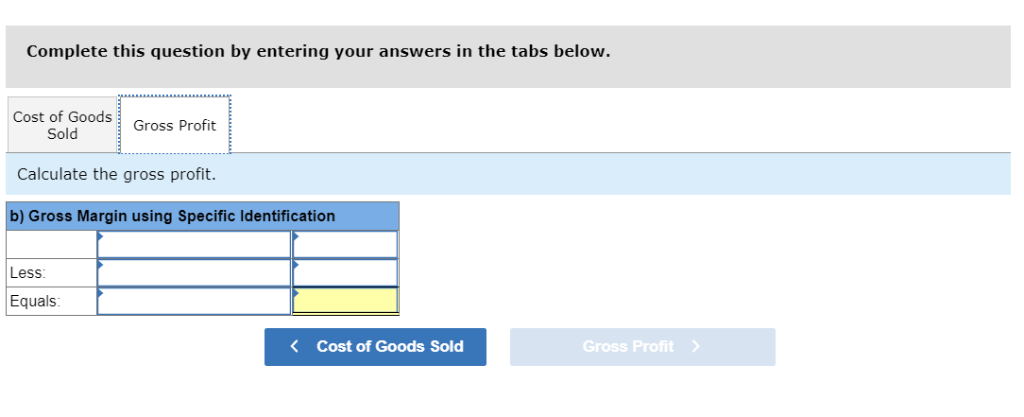

Calculate the cost of goods sold. While both gross profit and gross margin connote the same thing which is the retention of revenue after netting it. Gross Margin Revenue Cost of Goods Sold Revenue 100 For Year 2017 Gross Margin 21775 billion 11751 billion 21775 billion 100 Gross Margin 4603 For Year 2018 Gross Margin 22157 billion 12034 billion 22157 billion 100 Gross Margin 4569.

In this example if a box of cereal costs 115 divide 115 by 065 to find the retail price equals 177 at a specific profit margin of 35 percent. In this example subtract 035 from 1 to get 065. 20 and sells it at Sh.

Gross margin Revenue Cost of sales. Here are the steps to calculating gross margin. Suppose you sell expensive.

Rosemary Njeri Gross margin is the amount remaining after a retailer or manufacturer subtracts the cost of goods sold from the net sales. In the financial projections template gross margin shown on the income statement is calculated as a percentage of forecast revenue using the gross margin percentage. In this case it is called the gross margin ratio or gross profit percentage.

Required information The following information applies to the questions displayed below Hemming Co. A bottled water trader buys each bottle at Sh. The cost of specific items that are sold during a period is included in the cost of goods sold for that period and the cost of specific items remaining on.

102007 39023 102007 06174 6174 This means that for every dollar generated 03826 would go into the cost of goods sold while the remaining 06174 could be used to pay back expenses taxes etc. Now we could calculate the gross margin by reducing COGS from net sales. Company A is a pure SaaS company offering a B2B turnkey solution through monthlyannual subscriptions.

Therefore the margin is 60 Prev Article Next Article. The gross margin is the profit calculated on the selling price of an article. Gross margin refers to the percentage of a companys revenue that it retains after accounting for the Cost of Goods Sold or COGS.

Margin Formula for a shop. For example for a repair shop. Gross margin can be a specific amount in which case it is called the gross profit.

Repeat for each product sold by the company. Gross margin can also be a percentage of the net sales of a business. How to Increase the Gross Margin Ratio.

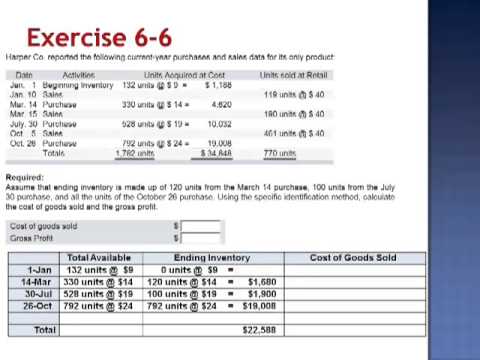

Using the specific identification method calculate the a the cost of goods sold and b the gross profit. Examples of Gross Margin Formulawith Excel Template Let us see some simple to advanced models of the gross margin equation to understand it better. The 220 lamps Lee has not yet sold would still be considered inventory.

The type of margin we will discuss is the gross profit margin which describes the profit that you earn on a product as a percentage of the selling price. Continuing the same example 75 percent x 25 percent 1875 percent. 1 295 240 3312 0 1380 0 Cost Per Unit 1380 1880.

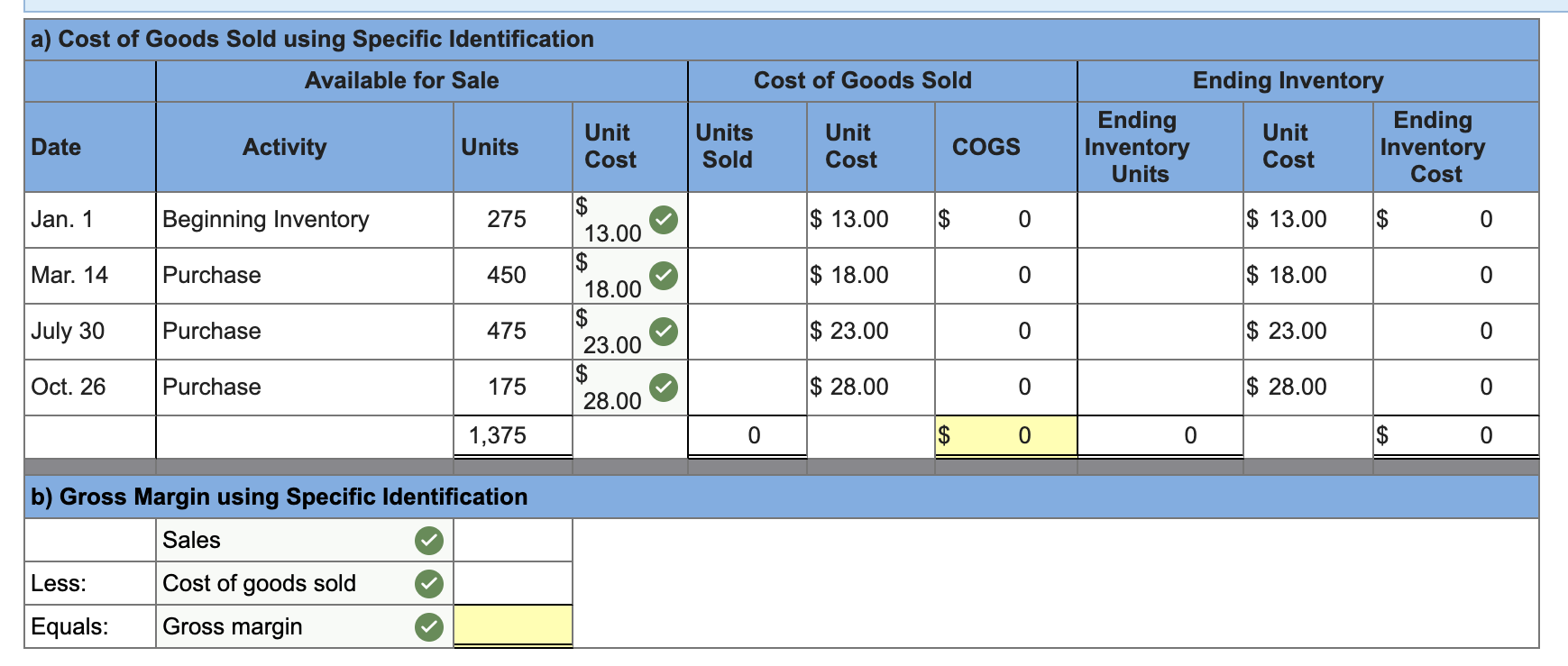

You use the same COGS formula for calculating gross margin using specific identification according to Accounting for Management but you derive the numbers differently. A Cost of Goods Sold using Specific Identification Available for Sale Cost of Goods Sold Date Activity of units sold Ending Inventory Cost Per Ending Unit Inventory Cost of units Cost Per Unit Ending Inventory Units COGS Jan. In this demonstration assume that some sales were made by specifically tracked goods that are part of a lot as previously stated for this method.

Calculations of Costs of Goods Sold Ending Inventory and Gross Margin Specific Identification. To calculate gross margin first identify each variable of the formula and then fill in the values. Under this method each item sold and each item remaining in the inventory is identified.

Gross margin Revenue x Gross margin. Using the specific identification method calculate the following. Specific identification method can be applied in situations where different purchases can be physically separated.

Both total revenue and costs of goods sold are located on the income statement. Enter your sell and cost prices and this calculator will show you the gross margin and mark up. With 1 million in sales with a 100 000 in profit We would all say that he as a 10 gross margin.

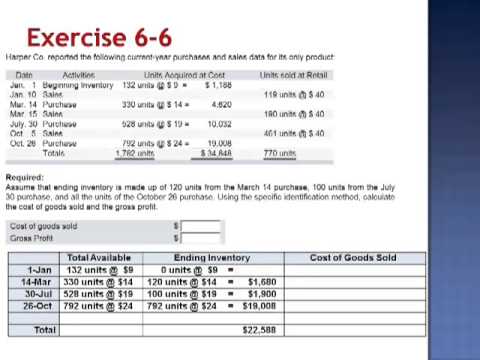

Reported the following current-year purchases and sales for its only product. To calculate the selling price based on the cost with a margin in. How to Calculate Gross Margin.

Multiply each products gross profit margin by that products percentage of total sales. After further analysis we found that Company A books all salaries and wage expenses commissions and bonuses as CoGS resulting in the low gross margin. Because Lee is going by the LIFO method he is using the most recent cost of 10000 per lamp in the calculation Although using the LIFO method will cut into his profit it also means that Lee will get a tax break.

Formula to calculate margin. For The Spy Who Loves You the first sale of 120 units is assumed to be the units from the beginning. 80 x 10000 8000.

To calculate gross margin subtract Cost of Goods SoldCOGS from total revenue and divide that number by total revenue Gross Margin Total Revenue - Cost of Goods SoldTotal Revenue. Gross Margin is calculated using the formula given below. Calculate the weighted gross margin for all products sold by the company.

Combine the variables to determine the gross margin. Company As gross margin is only 25 which is far below our investment criteria of 50. The formula to calculate gross margin as a percentage is Gross Margin Total Revenue Cost of Goods SoldTotal Revenue x 100.

The specific identification costing assumption tracks inventory items individually so that when they are sold the exact cost of the item is used to offset the revenue from the sale. It is possible to calculate the gross margin for a particular product line of a business or it can. Gross margin is important because it shows whether your sales are sufficient to cover your costs.

Solved Required Information The Following Information Chegg Com

Periodic And Perpetual Inventory System Methods Examples Formulas

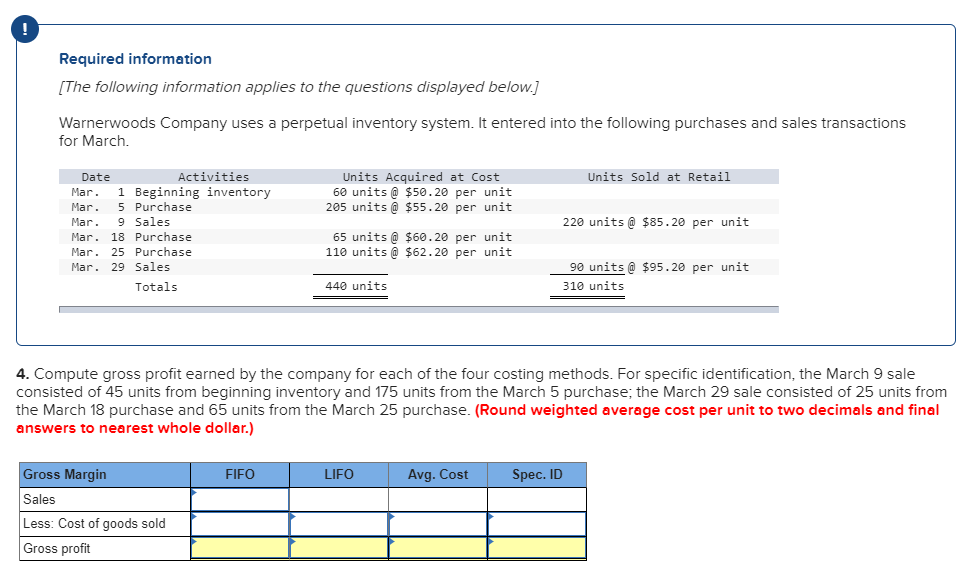

Solved Warnerwoods Company Uses A Perpetual Inventory Chegg Com

Specific Identification Inventory Costing Specific Inventory Used Cogs Ending Inventory Youtube

Solved Hemming Co Reported The Following Current Year Chegg Com

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Solved Compute Gross Profit Earned By The Company For Each Chegg Com

Solved Required Information The Following Information Chegg Com

Specific Identification Inventory Method Double Entry Bookkeeping

Inventories 2 Notes Study Principles And Practice Of Accounting Ca Foundation

Specific Identification Method Explained Exercise 6 6 Youtube

Please Complete 3 And 4 Montoure Company Uses A Periodic Inventory System It Entered Into The Homeworklib

Solved Hemming Uses A Periodic Inventory System Assume That Chegg Com

Hemming Co Reported The Following Current Year Purchases And Sales For Its Only Product Date Activities Uni Homeworklib

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment